A Risk Managed Trade in GS

Goldman Sachs, the ‘vampire squid’, the ‘planet-eating deathstar’ — whatever everyone calls it — is a company that is not likely to leave the spotlight any time soon. With news of another subpoena regarding its alleged criminal role in the financial crisis, it is clear that $GS is main stream America’s favorite investment bank to hate.

Love them or hate them, there are plenty of opinions and theories floating around on the stream about why $GS is a “great buy” because of rumors that “they are in bed with the government”. Read as many articles as you want. So much has already been said on both sides, including an article by Michael Lewis (July,2009) dispelling some of the rumors. Who knows what the ultimate truth is? Frankly, I don’t care. In my opinion, that is non-actionable noise, and serves no basis for a trade.

Earlier today I had a short conversation with a member of the stream, @MarketShot in which he stated he was willing to go long $GS at these levels because large buyers are willing to step in at these levels, among other less notable reasons. Ok, fair enough. It’s good that someone is willing to stick their neck out with an opinion and draw a clear line in the sand. My response, I realized soon after, was probably related to the fact that I had recently been absolutely burned by a trade I made in Goldman. I went long $GS one day before the most recent subpoena news, and took a massive hit to the shares I held overnight, and that admittedly left a bit of a sting. I even tried to step in on the other side of the trade and short the name, expecting the same type of stock shock we saw in 2010. Unfortunately, GS actually rose from the 131 area quickly to 135 and as high as almost 137 the next day. So I got burned twice in two days on Goldman Sachs. That kind of action and “twice burned” pain is enough to keep most away for a while. It probably has given me a negative bias on the stock as well, which honestly is not profitable in the long run.

The real point here is that I never went into the trade with a risk managed mindset. Part of the reason I got in was because of the massive bull trap that got a lot of people sucked into the market last week.

What I’d like to offer the stream tonight is not opinions, grief or regret. Instead, I’d like to provide what I think is a real actionable trade in $GS that allows you to participate to the long side of $GS without getting your face ripped off in the event Goldman takes it on the chin going forward.

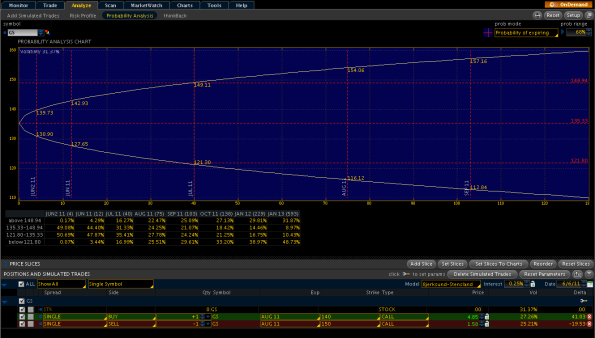

AUGUST 140/150 CALL SPREAD

Have a look at the $GS August 140/150 Call Spread. This allows you to participate in a positive directional movement in Goldman without a lot of capital up front, and allows some time to pass so that the recent news can be absorbed. If the news isn’t absorbed by July’s expiration, you’d likely be down in a pure equity position, and it would be more of a loss than the cash outlay described here.

For the GS AUG 140 CALL, you can expect to pay close to the ask price of 4.85

For the GS AUG 150 CALL, you can expect to get close to the bid price of 1.58

=============================================================================

For the GS AUG 140/150 CALL SPREAD, you can expect to lay out a debit of 3.27

For each call spread you take on, you’ll spend $327 (max risk) to participate in (150-143.27)*100= 673 max profit.

It’s a lot easier to get net long $GS laying out $327 in risk capital than putting up the full $13,500 you’d need to buy 100 shares of GS otherwise. It will also allow you to sleep at night without worrying about waking up to yet another day of panic selling that I witnessed while I was long the stock.

Does this mean you necessarily hold this position to expiration? Well, that depends on how bullish you are on the stock. If you plan on holding the entire time and are willing to risk the entire premium of the position, please keep your contracts small.

If you’d rather play a more active role in managing the position, you might want to consider increasing the number of spread contracts you take on. For instance, taking this scenario further, you will notice that your effective net delta of the position will be 41.03-19.53, or 21.50. You’ll be effectively long about 21.50 shares of GS stock at the time you take the position on.

You can use a Risk Analysis tool to adjust your potential stop loss price based on the maximum draw down you’d be willing to take. Just taking a look at one scenario, if Goldman took a $20 hit tomorrow while you were holding 100 shares, you’d be down $2,000 very quickly, and would likely bail on the shares. If in that same time you were holding 5 spread contracts instead, you’d be down less $ at the same share price because of your lower delta (not 1). Now, you have to account for theta and gamma exposure as time goes on, but this scenario is still safer and less risky than holding GS at these levels whether or not we are about to bounce off of multi-year support.

Please let me know if you have any comments, suggestions, or if you take the trade. Thanks!

Hey man, nice review of your GS trade.

But as for the options play, I cant comment. I dont do options, im the worst at it. But good luck if you do decide to take it.

Since when is Goldman Sachs liquid enough for trading?